nevada estate tax rate

Sets the current and delinquent tax rates. 60 is added.

Estate Planning Chapter Ppt Download

An estate that exceeds the Federal Estate Tax Exemption of 1206 million becomes subject to taxation.

. 200000 taxable value x 35 assessment ratio 70000. 041 effective real estate tax rate 3. 051 effective real estate.

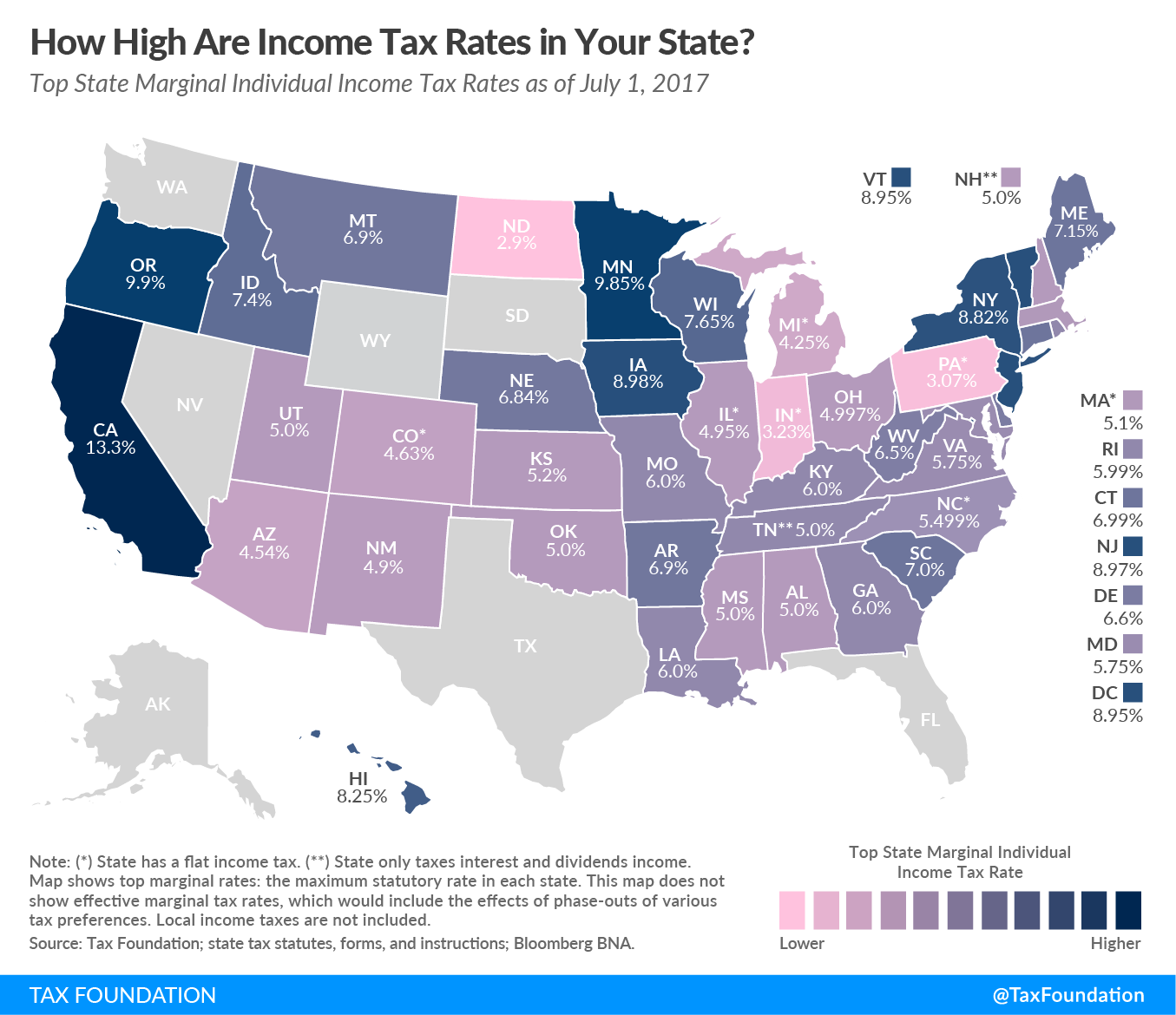

The Nebraska state sales and use tax rate is 55 055. Counties cities school districts special districts such as fire. Only the Federal Income Tax applies.

Nevada has a 685 percent state sales tax rate a max local sales tax rate of 153 percent and an average combined state and local sales tax rate of 823 percent. 10 is added. States with the lowest property taxes 1.

Nevada has no state income tax. Nevada is one of seven states that do not collect a personal income tax. Nevada Income Tax Table Note.

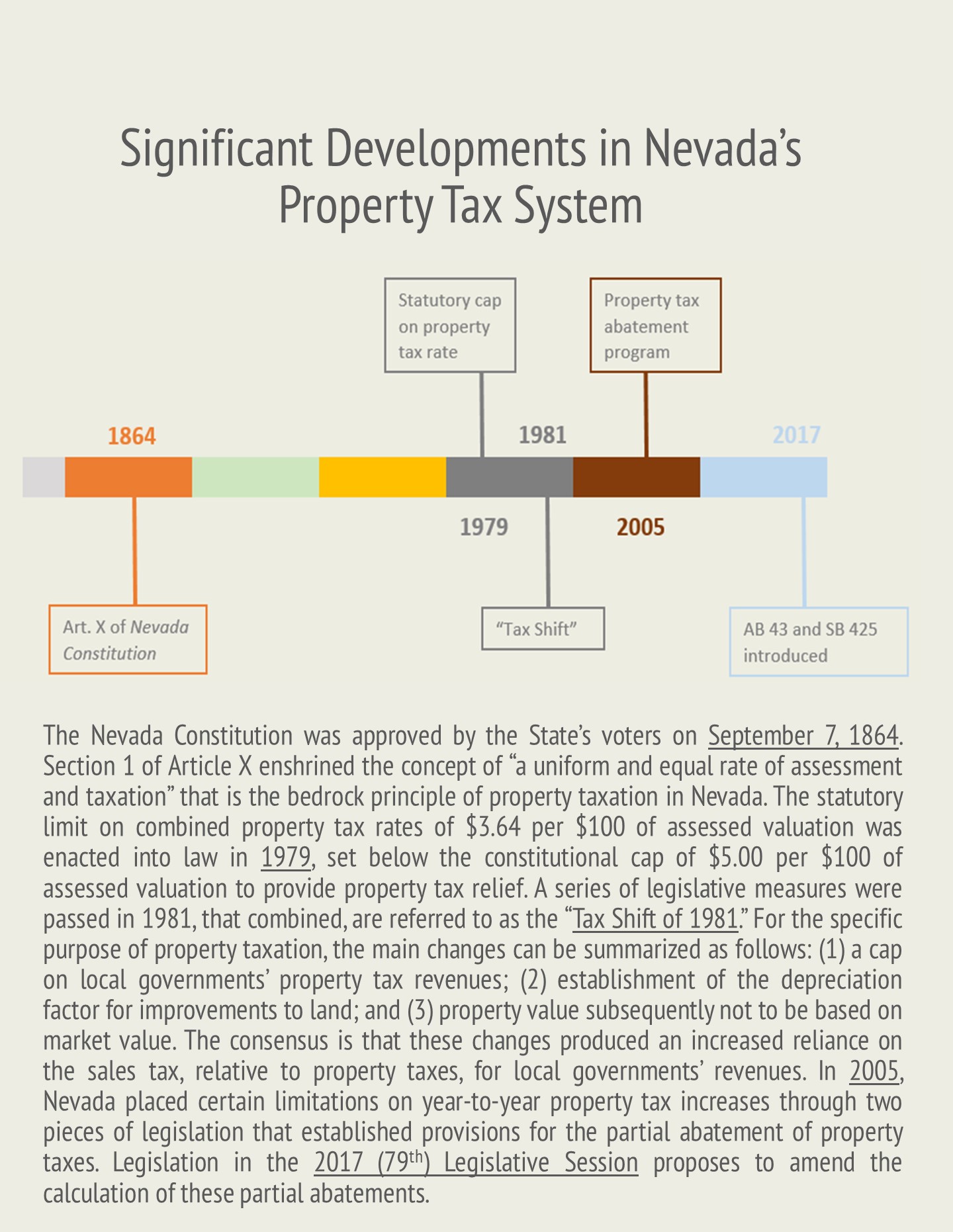

These rates are then applied to the. The total overlapping tax rate subject to approval by the Nevada Tax Commission for the City of Reno is 3660615 per 100 of assessed valuation. Tax Rate 32782 per hundred dollars Determine the assessed value by multiplying the taxable value by the assessment ratio.

The Declaration of Value is a form prescribed by the Nevada Tax Commission. This is after budget hearings and review by the State Department of Taxation. Skip to main content.

Please visit this page for more information. 028 effective real estate tax rate 2. If the time of death is on or after January 1 2005 Nevada does not require filing of Estate Tax and will not require filing until which time the Internal Revenue Service reenacts the Death Tax.

The median property tax in Nevada is 174900 per year for a home worth the median value of 20760000. Nevada City CA 95959. Property Tax Rates for Nevada Local Governments Redbook NRS 3610445 also requires the Department to post the rates of taxes imposed by various taxing entities and the revenues.

Counties in Nevada collect an average of 084 of a propertys assesed fair. The federal Estate Tax has a progressive rate that starts at 18 and can reach up to. The property tax rate for Carson City is set each year around the end of June.

Nevadas tax system ranks. The Clark County Treasurer provides an online payment portal for you to pay your property taxes. 195 for each 500 of value or fraction thereof if the value is over 100.

Notification to Permitholders of Changes in Local Sales and Use Tax Rates Effective January 1 2021 Updated. The property may be redeemed by payment of taxes and accruing taxes penalties and cost together with interest on the taxes at the rate of 10 percent per annum from the original date. The property tax rates are proposed in April of each year based on the budgets prepared by the various local governments.

Nawbo Southern Nevada The Salvation Army Presents Dine And Discover Wealth Management Estate Planning Seminar Presenters Craig Stone Estate And Business Attorney Greg Bodine Senior Gift Estate Planner The Salvation

Nevada Estate Tax How 99 Of Residents Can Avoid

States With The Lowest Taxes And The Highest Taxes Turbotax Tax Tips Videos

State Death Tax Hikes Loom Where Not To Die In 2021

Nevada Tax Rates And Benefits Living In Nevada Saves Money

Transfer On Death Tax Implications Findlaw

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation

Median United States Property Taxes Statistics By State States With The Best Worst Real Estate Tax Rates

How Idaho S Taxes Compare To Other States In The Region Boise State Public Radio

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Nevada Tax Rates And Benefits Living In Nevada Saves Money

All Eyes On Nevada Real Estate For 2018 Tahoe Luxury Properties

Nevada State Taxes Everything You Need To Know Gobankingrates

Quartet Of Business Groups Join Gop Suit To Overturn Extension Of Payroll Tax Rate The Nevada Independent

Property Taxes In Nevada Guinn Center For Policy Priorities

.png)

:max_bytes(150000):strip_icc()/states-without-an-income-tax-3193345-0407c7e1645442deb4af9469534bd165.png)